20+ Tax Calculator Indiana

Your average tax rate is 1198 and your. Effective tax rate 561.

Indiana Paycheck Calculator Adp

Total income tax -12312.

. Departmental Notice 1 contains the most. Marginal tax rate 633. Web Select a tax district from the dropdown box at the top of the form.

Web The Indiana Tax Calculator Estimate Your Federal and Indiana Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married Filing Joint. Web The Indiana tax calculator is updated for the 202223 tax year. As an employer you must match this.

The IN Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow. How much do you make after taxes in. Web Free calculator to find the sales tax amountrate before tax price and after-tax price.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Web Indiana Paycheck Calculator Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Purchase Amount Purchase Location.

Also check the sales tax rates in different states of the US. Enter an assessed value for the. Select Tax Year 1.

Web How to Calculate Sales Tax Multiply the price of your item or service by the tax rate. Web For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year. New York state tax 3925.

Web The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Web Residents of Indiana are taxed at a flat state income rate of 323. Just enter the wages tax.

Web Return to Taxpayer Portal Tax Bill Estimator The figures provided by this tool are estimates only and should not be taken as a statement of true tax liability. Web Indianans pay a flat income tax rate of 323 plus local income tax based on the county which ranges from 035 to 338. All counties in Indiana impose their.

Web Indiana Income Tax Calculator 2021 If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. County income tax rates may be adjusted in January and October. Web The Indiana individual adjusted gross income tax rate is 323.

The district numbers match the district number you receive on your bill. Web If you make 55000 a year living in the region of Indiana USA you will be taxed 10852. That means no matter how much you make youre taxed at the same rate.

New York on the other hand. That means that your net pay will be 44148 per year or 3679 per month.

2022 Solar Panel Costs Average Installation Cost Calculator

Kentucky Map Print Minimalist State Map Katie Ford Etsy Denmark

Indiana 8 In 1 Mixed Nuts And Dry Fruits 800 G Pumpkin Seed Sunflower Seed Flax Seed Watermelon Seeds Muskmelon Seed Almonds Cashew Cranberry Amazon In Grocery Gourmet Foods

71000 A Year Is How Much An Hour Full Financial Analysis Savoteur

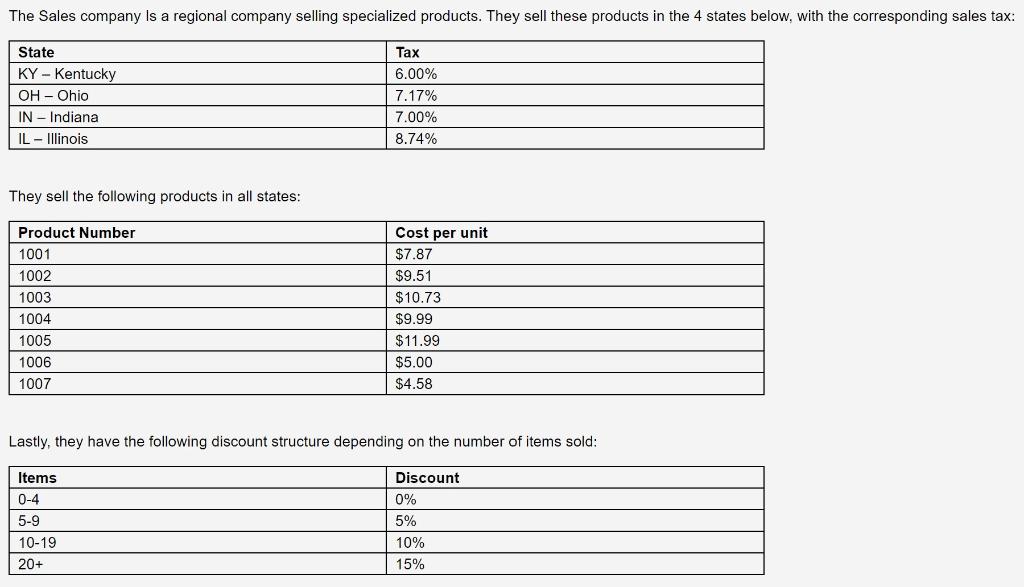

Our Goal Is To Create An App Allowing The User To Chegg Com

Tax Rate Calculator

Indiana U S Small Business Administration

Indiana Natural Immunity Booster Dry Fruit Big Size 1 Kg Amazon In Grocery Gourmet Foods

Cash Out Refinance Find My Way Home

:max_bytes(150000):strip_icc()/fhaloan.asp-6b3a202ce0bb4040937398e14ffe943d.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Present Value Of Apple Plant According To Expected Net Cash Flows Download Scientific Diagram

214 Indiana Ave Dayton Oh 45410 Mls 844614 Redfin

131 Indiana Ave Dayton Oh 45410 Mls 849451 Redfin

3 Fatal Income Calculation Mistakes And How To Avoid Them Find My Way Home

Nashville General Store Nashville In 47448 For Sale Mls 21863960 Re Max

Gtm Household Payroll Nannytaxes Twitter

Sales Process Excellence Podcast Podcast Podtail